puerto rico tax incentives 2021

Instead the 2021 tax year would be the first full tax year for which you could claim residence in Puerto Rico qualifying you for the exemption in. Tax attorneys anticipate a lot of audits from IRS on residency and source income.

Puerto Rico Incentives Code Act 60 2019 Signed Into Law Relocate To Puerto Rico With Act 60 20 22

Taxes levied on their employment investment and corporate income.

. The Tax Incentive Code known as Act 60 provides tax exemptions to businesses and investors that relocate to or are established in Puerto Rico. June 3 2021 846 AM. Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico.

Sometimes effective tax planning can help avoid these taxes. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world. Residents and firms have moved to.

The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains. The Code shall create a simple streamlined. If a foreign corporation indicate if the trade or business in Puerto Rico YES NO NA was held as a branch.

If a branch indicate the percent that represents the income from sources within Puerto Rico from the total income of the exempt business_____ 3. As provided by Act 60. In other words there were more than 1350 fewer forms than decrees issued.

The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. More than 4000 mainland US.

More importantly the requirements for each program have been adjusted. Of tax incentives designed to lure high net-worth individuals and corporations to Puerto Rico. Most recently then Governor of Puerto Rico Ricardo Rossello signed Act 60-2019 Incentives Act into law on July 1 2019 with an effective date of January 1 2020.

Puerto Rico Incentives Code 60 for prior Acts 2020. Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of. Alongside Democratic Reps.

To help with your diligence weve distilled the latest and most important information about Act 60 Act 20 and Act 22 and the relocation all in one place for easy consumption so that. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012.

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. The incentives are particularly attractive to US. Investors and businesses have already moved to Puerto Rico to take advantage of the islands gorgeous weather low prices and vibrant Hispanic culture in addition to its tax benefits.

Benefits of establishing relocating or expanding businesses in Puerto Rico. For instance if you decided to move to Puerto Rico in October of 2020 you would not qualify for the 0 capital gains tax in 2021 because you did not spend at least 183 days in Puerto Rico in 2020. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

The law has enabled high-income individuals and profitable service. For taxable year 2019 the Puerto Rico Treasury Department received 1044 returns from individuals who had the incentive. 42 Puerto Rico tax and incentives guide 2021.

Tax and incentives guide. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect. Under the umbrella of the Act 20 tax incentive the entity in Puerto Rico will pay 4 corporate tax for eligible export services and receive a 100 exemption on dividends for PR bona fide resident shareholders.

Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven. Purpose of Puerto Rico Incentives Code Act 60. Steven Mnuchin demanding greater oversight into and more information about the Puerto Rico tax incentives that are resulting in US.

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. 100 exemption from income tax on the appreciation in value of the securities or other assets ie cryptocurrency after becoming a bona fide resident of Puerto Rico and realized before January.

Puerto Rico Tax Incentives Act 2022 Doing Business in Puerto Rico Moving to Puerto Rico. Chapter 2 of the Incentives Act includes measures to attract individual investors to Puerto Rico by providing many incentives to resident individuals such as full tax exemptions on Puerto Rican-source. The DDEC had more than 2400 decrees in place then.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. More importantly the requirements for each program have been adjusted. A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US.

Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. Many high-net worth Taxpayers are understandably upset about the massive US. Consider moving to the island in 2021 to take advantage of the income and capital gains tax benefits before Bidens tax plan comes into effect.

Despite the increased fees applying for these lucrative tax benefits is still a worthwhile investment however as they can result in a 4 corporate tax rate or a 0 capital gains tax rate. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness. Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity.

José Serrano Nydia Velázquez and Raúl Grijalva Ocasio-Cortez signed a Dec. The Incentives in a Nutshell. The goal of tax planning is to legally limit minimize and if possible avoid US tax while also.

Also during the year 2012 two additional laws were enacted. More than 4000 individuals and corporations have moved to Puerto Rico. As of January 20 2021 the Puerto Rican government has introduced increased fees for tax incentive applications codified in the Incentive Code Regulation.

19 2019 letter to Treasury Sec. Citizens who move to Puerto Rico because they do not need a residency permit their Puerto Rico income is exempt from US. Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22.

Puerto Rico US Tax.

Incorporate A Business In Puerto Rico A 5 Step Guide Biz Latin Hub

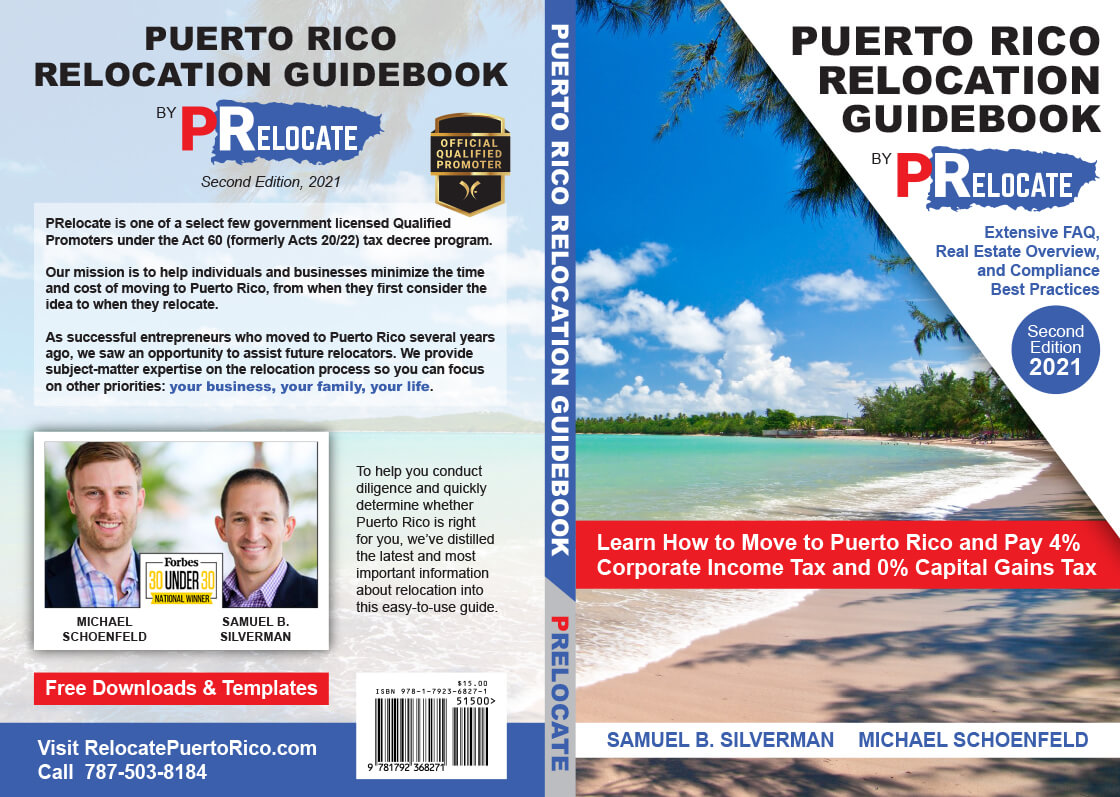

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Tumblr Puerto Rico Sotheby S Realty Luxury Real Estate Real Estate Puerto Rico

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call

Faqs Tax Incentives And Moving To Puerto Rico

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Moving To Puerto Rico Your Easy Escape To Caribbean Life

Guide To Income Tax In Puerto Rico

Incorporate A Business In Puerto Rico A 5 Step Guide Biz Latin Hub

Puerto Rico Home Solar And Battery Storage Pr Home Solar Panels Incentives Rebates Cost And Savings Sunnova In 2021 Solar Panels For Home Solar Panels Solar

Additional Tax Incentives Baltic Avenue Investments

4 Business Opportunities In Puerto Rico Biz Latin Hub

Guide To Income Tax In Puerto Rico

Us Tax Filing And Advantages For Americans Living In Puerto Rico

4 Business Opportunities In Puerto Rico Biz Latin Hub

How You Can Move To Puerto Rico And Pay Almost Zero Tax Tax Law Solutions